Rare earth elements are no longer obscure materials used only in laboratories. They have become central to global politics, economic security, and military power.

From smartphones and semiconductors to electric vehicles and missile systems, these rare minerals turn the heart of modern industry.

In 2025, the world saw a clear picture of how control over rare-earth supply chains can shift the balance of power. Governments, corporations, and defence planners are now treating these materials as strategic assets rather than simple commodities.

The global rare earth market entered a new phase after China tightened export controls on selected rare earth elements and related technologies. Licensing requirements became stricter, and certain high-value magnet materials were subject to additional scrutiny.

The move triggered immediate reactions across industries. Manufacturers dependent on rare earth magnets experienced delays. Prices of several elements rose sharply during periods of uncertainty. Investors and policymakers began to question the security of global supply chains.

READ ALSO: https://modernmechanics24.com/post/tepco-niigata-reactor-restart-alarm/

This was not a case of the world running out of rare earths. Deposits exist in many countries. The real problem lies in processing. Mining is only the first step. The critical stage is refining, separating, and converting rare earths into high-performance magnets and alloys. That stage is heavily concentrated in China.

Now, China produces roughly 70 percent of global rare earth output. Most importantly, it controls 85-90% of global refining capacity. It also manufactures more than 90 percent of the permanent magnets used in electric motors and defence equipment.

This concentration means that even when rare earth ore is mined in Australia or the US, it often travels to China for processing before entering global markets.

Why Rare Earths Matter

Rare earth elements are vital for technologies that define the 21st century.

Electric vehicles (EVs) rely on powerful permanent magnets made from neodymium and dysprosium. These magnets make motors smaller, lighter, and more efficient.

Wind turbines use rare-earth magnets to generate stable electricity at scale.

Smartphones and computers use rare-earth elements for displays, speakers, and circuitry.

Defense systems use rare-earth alloys in radar, navigation equipment, and precision-guided weapons.

For example, the US’s F-35 Lightning II uses hundreds of kilograms of rare earth materials across its sensors and electronic systems. Without steady access to these elements, advanced military platforms would face supply constraints.

Global demand is rising fast. As countries accelerate the clean energy transition and expand digital infrastructure, rare earth consumption is expected to grow sharply by 2040. Some projections estimate demand could increase several-fold as electric vehicle production and renewable energy installations expand.

WATCH ALSO: https://modernmechanics24.com/post/drdo-akhash-ng-missile-trials-success/

Summarily, rare earths are now as strategically important to the digital and green economy as oil was to the industrial age.

China did not achieve dominance by chance. Over the past three decades, Beijing has invested heavily in rare-earth mining, refining, and magnet production. It supported domestic companies, built processing facilities, and developed expertise in complex separation techniques.

Many Western countries allowed refining capacity to decline due to environmental costs and lower short-term profitability. Over time, production shifted toward China, where economies of scale and state support reduced costs.

The result is a vertically integrated supply chain that gives China strong influence in global markets. Control over refining provides leverage in trade negotiations and geopolitical tensions.

History shows how resource control can shape global power. In the 1970s, the Organization of the Petroleum Exporting Countries’ oil embargo disrupted Western economies and reshaped energy policy. In the early 2020s, semiconductor shortages revealed how concentrated manufacturing can stall entire industries. Rare earths represent a similar chokepoint.

Challenges Attached

Rare-earth dependence creates vulnerabilities in both the public and private sectors.

Defense planners in the US have identified mineral dependency as a national security concern. In a crisis, the inability to access refined materials could slow the production of advanced weapons systems.

The risk extends beyond defense. Car manufacturers, battery producers, and semiconductor companies rely on a stable supply. The just-in-time manufacturing model leaves little room for prolonged disruptions.

In 2025, some automakers adjusted electric vehicle production targets due to supply uncertainty. Companies began reviewing contracts and exploring alternative suppliers. Governments responded by expanding strategic reserves and launching new domestic initiatives.

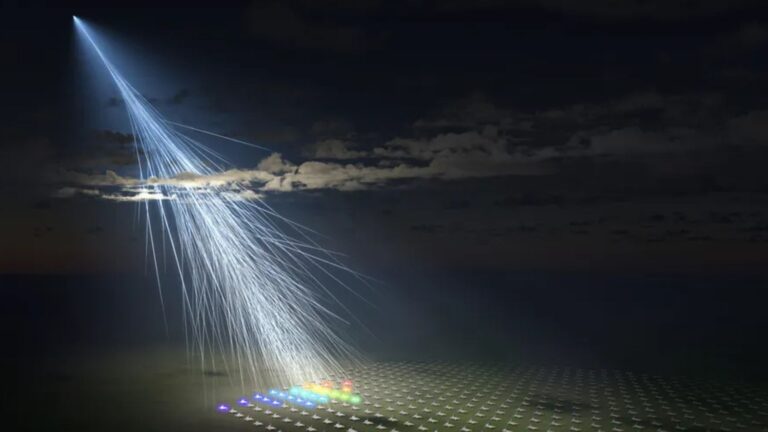

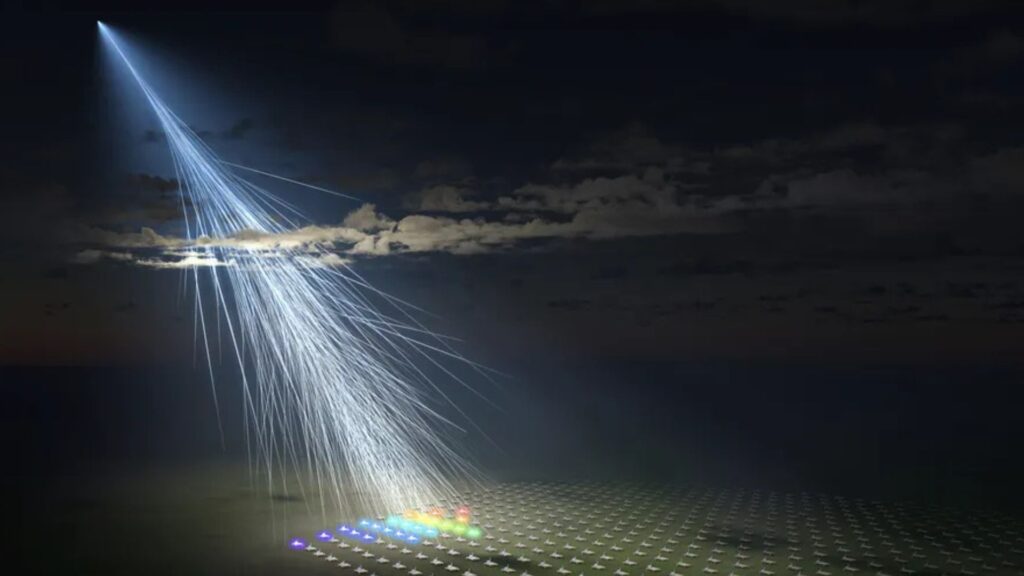

READ ALSO: https://modernmechanics24.com/post/sun-goddess-particle-mystery-in-space/

Global Responses

Countries are now racing to diversify supply chains.

The US has committed billions of dollars to domestic mining and refining projects. The European Union, under its Critical Raw Materials Act, aims to process 40 percent of its rare earth needs within Europe. Japan is investing in recycling and long-term supply contracts.

More than 300 million tonnes of rare earth resources have been identified outside China. At least 146 projects are under development globally. However, building new mines and processing plants takes years, sometimes a decade or more.

India has also stepped in. Despite holding around 6 percent of global reserves, it imports nearly all its rare earth magnets. In response, New Delhi approved a ₹7,280 crore incentive scheme to build domestic magnet production capacity of about 6,000 tonnes per year.

The goal is to reduce dependence and support the country’s manufacturing ambitions under the “Viksit Bharat” vision. Success will depend on faster approvals, investment in refining capacity, and technology partnerships.

Even with these efforts, replacing China’s dominance will not happen overnight. Developing a new mine can take up to a decade. Establishing processing capacity requires advanced technology and skilled labor.

Power Shift

Rare earths are not just about trade. They are about influence.

Countries that secure reliable and diversified supply chains gain economic stability. They can expand electric vehicle production, invest confidently in renewable energy, and maintain advanced defence capabilities.

Those who remain dependent face exposure to policy shifts and geopolitical tensions.

China continues to invest in next-generation battery technologies, recycling methods, and magnet innovation. By improving efficiency and exploring substitutes, it aims to strengthen its long-term position.

WATCH ALSO: https://modernmechanics24.com/post/china-humanoid-robot-embroiders-itself/

Meanwhile, Western nations are debating how to balance environmental concerns with strategic necessity. Faster permitting, public-private partnerships, and coordinated international investment are emerging as key themes.

The rare earth race is entering a decisive phase. Demand is expected to rise sharply as green energy systems expand worldwide. Artificial intelligence infrastructure, data centers, and advanced electronics will add further pressure on supply.

In this environment, secure supply chains are becoming as important as technological innovation.

Rare earth materials have earned a new label: the “new oil” of the digital era. But unlike oil, their strategic value lies not only in extraction, but in processing and advanced manufacturing.

The next global superpower may not simply be the country with the largest reserves. It may be the nation that builds the most resilient, efficient, and diversified rare-earth supply chain.

As governments act and industries adapt, one lesson is clear. Control over rare earth materials is no longer a technical issue buried in mining reports. It is a defining factor in global economic strength and national security.

The global power map is shifting. And rare earths are at the center of that transformation.